| by Admin

Covered calls are a popular options trading strategy that involves holding a long position in a stock and selling call options on that same stock in order to generate income. This strategy can be used to generate income from stocks that you already own, or as a way to reduce the cost of purchasing a stock by selling call options against it. In this article, we will discuss how covered calls work, the potential benefits and risks of using this strategy, and how to get started with covered calls.

When you sell a call option, you are giving the buyer of the option the right, but not the obligation, to purchase the underlying stock at a predetermined price (the "strike price") on or before a certain date (the "expiration date"). The price that you receive for selling the call option is known as the option premium.

One way to use covered calls is to sell call options on a stock that you already own. This is known as a "covered call" because you already own the underlying stock and therefore have the ability to sell it to the option buyer if the option is exercised. By selling call options on a stock that you already own, you are able to generate income from the option premium, which can offset some of the cost of purchasing the stock.

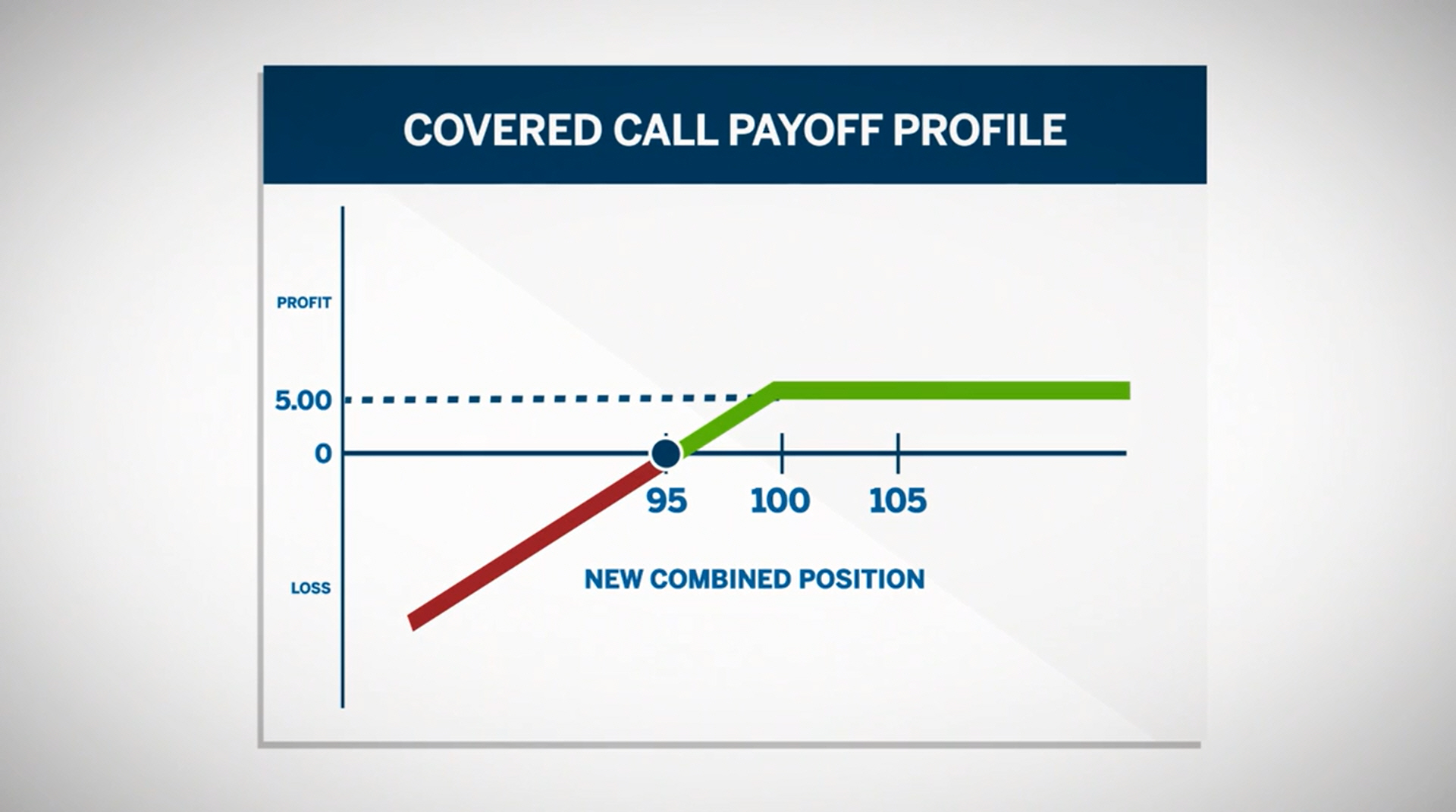

Another way to use covered calls is to sell call options on a stock that you are planning to purchase. This can be a way to reduce the cost of purchasing the stock by receiving the option premium upfront. For example, if you were planning to purchase a stock for $100 and you sold a call option with a strike price of $110 for $5, you would effectively only be paying $95 for the stock ($100 purchase price - $5 option premium). If the stock price remains below $110 at expiration, you would keep the option premium and own the stock at a reduced cost. However, if the stock price rises above $110, the option may be exercised and you would be required to sell the stock at the strike price of $110.

One potential benefit of using covered calls is the ability to generate income from stocks that you already own. This can be especially useful for investors who are looking for a way to generate income from their portfolio without having to sell their stocks. Covered calls can also be a way to reduce the cost of purchasing a stock by receiving the option premium upfront.

However, there are also some risks to consider when using covered calls. If the stock price rises significantly above the strike price of the call option, the option may be exercised and you will be required to sell the stock at the lower strike price. This can result in missed opportunities for capital gains if the stock price continues to rise. Additionally, if the stock price falls significantly below the strike price, you may lose the option premium and be left with a loss on the stock.

To get started with covered calls, you will need to have a brokerage account that allows you to trade options. You will also need to familiarize yourself with the options market and have a good understanding of how options work. It is important to carefully consider the potential risks and rewards of using covered calls and to have a well-defined investment strategy in place. It may also be helpful to seek the advice of a financial advisor or professional options trader before implementing this strategy.